- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

You know what would really help is some stock buy backs. That has always for Intel’s other CEOs.

I do not have professional experience in the financial industry or economics, but the concept of “stock buy backs” seems counter productive to good corporate governance (and competition for that matter).

I did not think the /s was required but maybe it was.

Stock buybacks are a huge part of how Intel got to this point. They took out massive low interest loans in the post 2008 eras and used that cash to play investors rather than invest in r&d or other market growth programs.

Companies used to (and some still) transfer profits to shareholders by paying periodic dividends. The stock buyback transfers profits to shareholders by raising the stock price. It became popular because capital gains are taxed at a lower flat rate than dividends.

Also, dividends are taxed when they are paid, but gains are taxed when the stock gets sold. Wealthy shareholders can sit on unrealised capital gains for years or decades, pay no taxes, and still access the wealth by putting the shares up as collateral for personal loans.

Stock buybacks are certainly popular with big and wealthy investors.

I understand the difference between dividends and stock buybacks. Just pointing out that it seems almost counter-intuitive on some level (a company buying its own stock).

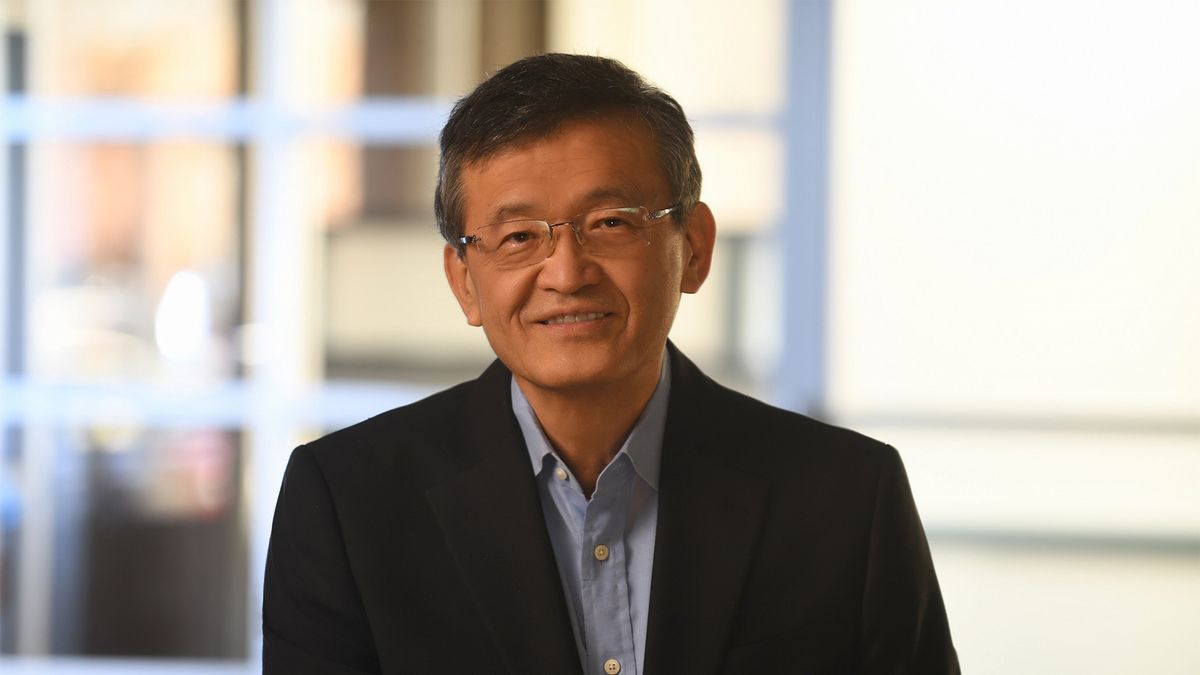

“I will lay you off with a smile on my face. Also, fuck you.” -Lip-Bu Tan 🤗

During his introductory video call, Tan — Intel’s first external CEO in its 57-year history —emphasized satisfying customers and shareholders. However, his appearance sparked some criticism, as he wore a shirt from his former company, Cadence Design Systems, instead of one carrying the Intel logo. He cautioned employees — many still unsettled by the recent job and spending cuts — that more difficult decisions were incoming. There are concerns that Tan, who reportedly stepped down from Intel’s board last year due to frustration with internal inefficiencies, may push for more job cuts.

Where his Cadence Design Systems shirt is very strange. How could Tan not understand the symbolism of this?