- cross-posted to:

- memes@lemmy.ml

- cross-posted to:

- memes@lemmy.ml

A thousand upvotes? Is this reddit?

What’s the exchange rate of Reddit karma to Lemmy nothings?

Reddit karma uses a logarithmic function to determine the karma on a post. The first upvotes give 1 karma each, but the higher the number gets the less karma you get from additional upvotes.

This isn’t even some theory based on observations, the reddit algorithm used to be completely open source so you can see how it works on github (or at least how it used to work 7 years ago).

Front page reddit posts with 50k points most likely have over a million upvotes in reality

1,763.64:1

From 97 million active users from reddit vs 55k users from Lemmy.

I think I saw this meme for the first time in 2017

I think crypto is good for transactions, not storing money.

Like, crypto in general sucks, but digital anonymous money transfer is almost impossible without it.

The underlying tech is actually very cool and neat, unfortunately it got co-opted by cryptobros and bastardized :(

So energy intensive though. There has to be a less wasteful way to do proof of work

Ethereum’s been proof-of-stake rather than proof-of-work for couple of years now, so it’s no longer energy intensive.

There inherently can’t be a way to make proof of work lies wasteful as long as there are people who want to do the work. If you make hardware more, then it makes it cheaper to do the same amount of work, so people buy more hardware and do more work and more power gets used. If you make hardware less efficient, people just use the old hardware. You have to abandon proof of work altogether and switch it to something else that isn’t inherently tied to energy usage.

This is what happens when you don’t use crypto as god intended: purchasing medication from India and subscriptions to indexers.

Purchase Bitcoin right before purchase. Watch the spare change left over go up and down and imagine all the millions you could be winning or losing.

This is what happens when you don’t use crypto as god intended: purchasing medication from India and subscriptions to indexers.

I’m not saying this is what I bought Monero for.

But this is what I bought Monero for.

No, man. People are sounding like these prices are fixed, when we’ve seen time and time again that crypto prices are cyclical.

Now’s a time to buy. ETH is at a 50% discount. Your assets would be in a pretty good spot right now if you’d bought Bitcoin in 2017 when it “crashed” to $4000 per unit. I picked up shares of EZBC at an average of $32 a share (currently hovering between $45-$50 in a supposed crash) and XRP at 50 to 75 cents, currently hovering around $2.10.

What you do is invest, and then just forget about it and let those assets sit. Investing is about forward-thinking.

Now’s a time to buy.

Never is it a good time to invest in a ponzi scheme. It’s just a matter of playing “Greatest Fool”.

“Greatest fool” description relies on the precept of its utility or demand returning to zero in a near-future timeframe. If people have utility for “the thing”, that won’t be the case.

There is no utility really, for ponzicoins. You can’t make anything from it. You can use it to make anything. You can’t eat it. You can’t hydrate with it. And you can’t use the notes to summon military aid.

I suppose you can buy drugs with it. Maybe.

So yes, it’s a Greatest Fool game.

Yes, for the limited subset of ERC20s or whatever you describe as “ponzicoins”. Things that actually do nothing, particular not doing anything more than L1 cryptos but “this is yet another token”, are not really adding any value. But I would be really surprised if you can name any more complex contracts than ERC20s (or ERC721s), which is where the work in the space actually goes.

“Work”

Yes, work. Smart contracts are designed, programmed and, if they’re done right, rigorously audited for correctness. Then you have user-facing interface and everything surrounding that as well. Look at the documentation of AAVE, for one example.

And this isn’t even getting into the protocol level (L1 or L2) work either. Bitcoin was relatively simple, Ethereum is not. They’ve spent years crafting these systems to function for PoS, L2 support, sharding, rollups, etc., at scale.

Smart contracts are designed, programmed and, if they’re done right, rigorously audited for correctness.

What do these “smart contracts” make? And why do we need to burn up tons of fossil fuels, just to have contracts like we had before?

And how is this better than a typical contract?

Bitcoin was relatively simple, Ethereum is not.

Both are simple ponzi schemes.

They’ve spent years crafting these systems to function for PoS, L2 support, sharding, rollups, etc., at scale.

And all that time, they are still ponzi schemes that do none of the above very well. We’ve had all of that in the merchant payment systems for decades now, all without the need to consume more electricity than many small nations, just to approve a transaction.

What is an “Ethereum”? Some sort of subscription?

It’s a pretty old cryptocoin: initally released back in 2015, and a significant change deployed in 2022. It was then when they changed from proof-of-work to proof-of-stake, which basically means that they don’t use mining anymore to keep the network running. They use like 1% of energy compared to PoW coins.

Also they have some smart contract capabilities which I suppose Ethereum people think are important. But I’ve never seen any practical use for that stuff.

Still, I think Eth is one of the cryptos that actually tries to be useful and efficient in some way and not just a stupid pump and dump scheme. Turns out, nobody gives a fuck about that, perhaps?

Also they have some smart contract capabilities which I suppose Ethereum people think are important. But I’ve never seen any practical use for that stuff.

Anything you need complicated multi-party interactions for that you want guarantees on. Real estate escrow comes to mind first. Depository accounts with yield. An immutable archive of records. Multi-signature corporate treasuries. Whatever. It’s programmable money. It’s not even necessarily monetary, because smart contracts can just deal with arbitrary data.

Never impressive to see a technical audience shit all over Ethereum for internet points. By far the least scammy crypto people have actually dedicated years into building something real on.

Would be great if they got some of that out there.

I reckon most of that already is. A real estate escrow smart contract is maybe 200-300 lines long in Solidity, depending of course on what it supports (contingencies and such). You may want to actually go look around, because there’s I don’t know how many millions of lines of Solidity already written. It doesn’t all get as much publicity as NFTs.

The off chain legalities are the tricky part of a real estate crypto deal.

Can changing house ownership really be as simple as making an alterations on a decentralized ledger?

You can mimic any existing setup for tracking deeds and similar, or invent new ones, with the added quality that they can’t be doctored. Once something is recorded, it’s recorded for good.

Blockchain is immutable but legal contracts usually are not. They have break clauses, implied rights etc.

I suspect everything can be implemented correctly, but my doubt isn’t technical, it’s legal.

Think of a smart contracts like a vending machine. You can’t just build one and start selling real things from it. Laws need to be followed.

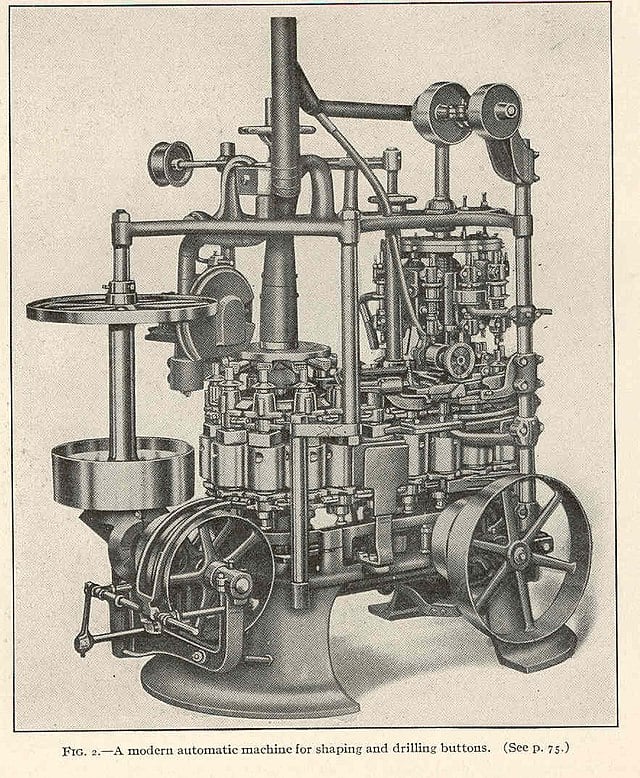

A cryptocurrency that recently lost a lot of its value

I can’t wait for people to realize they’re all in a pyramid scheme together. I’m sick of hearing bros saying crypto should be part of my portfolio.

If you can hold it long-term, it’s a fantastic investment.

If you’re a day trader that can’t look away from the charts for more than five minutes, then crypto definitely isn’t a good idea for you.

I’m sick of not hearing people saying that stocks and the rest of the casino economy are the exact same scam.

I don’t disagree, but there’s at least some capital and speculative value behind those companies. Crypto is straight up arbitrarily finite.